Introduction

This report analyses two decentralised Perpetual Futures exchanges using the Reach, Retention, Revenue framework from Covalent - the investigation has been completed using Increment, Covalent’s querying and charting product.

GMX is a spot and perp exchange offering its users a zero-price impact trading experience through the use of oracles. This same system ensures ‘scam wicks’ on CEX order books are not experienced on the platform, reducing a user’s likelihood of liquidation in a cascade event. The protocol uses a unique multi-asset pool (GLP) as liquidity for traders, where GLP holders are the counterparty to trader PnL. GLP holders earn 70% of all protocol fees as well as Escrowed GMX (esGMX). The other 30% is distributed to GMX (governance and utility token), along with esGMX and Multiplier Points. For more information visit the docs. For this investigation, only on-chain events from margin trading (perp) will be considered, not any swap events (spot).

Perp v2 is Perpetual Protocol’s iteration of their perp product. The exchange utilises Uniswap V3 pools for processing trades through an AMM with virtual tokens (vAMM). As such, price impact on trades is based on the depth of liquidity in the pool as well as the trade size. The protocol is currently in the middle of transitioning to a vote-escrow (vePERP) tokenomics model. Upon completion, 20% of fees will be distributed to vePERP holders and the DAO treasury, split equally, once the Insurance Fund has been adequately filled (10% of 30-day OI). LPs on the vAMM will earn the remaining 80% of the fees, as well as being the counterparty to trader PnL and suffering from impermanent loss of each pool. For more information visit the docs.

Reach

Reach encompasses growing a user base. Understanding where this growth originates from and how to drive it is critical to the success of a product. The transparency of Web3 easily allows us to visualise these metrics in order to monitor customer acquisition of a product.

GMX: Margin Transactions

Perp v2: Transactions

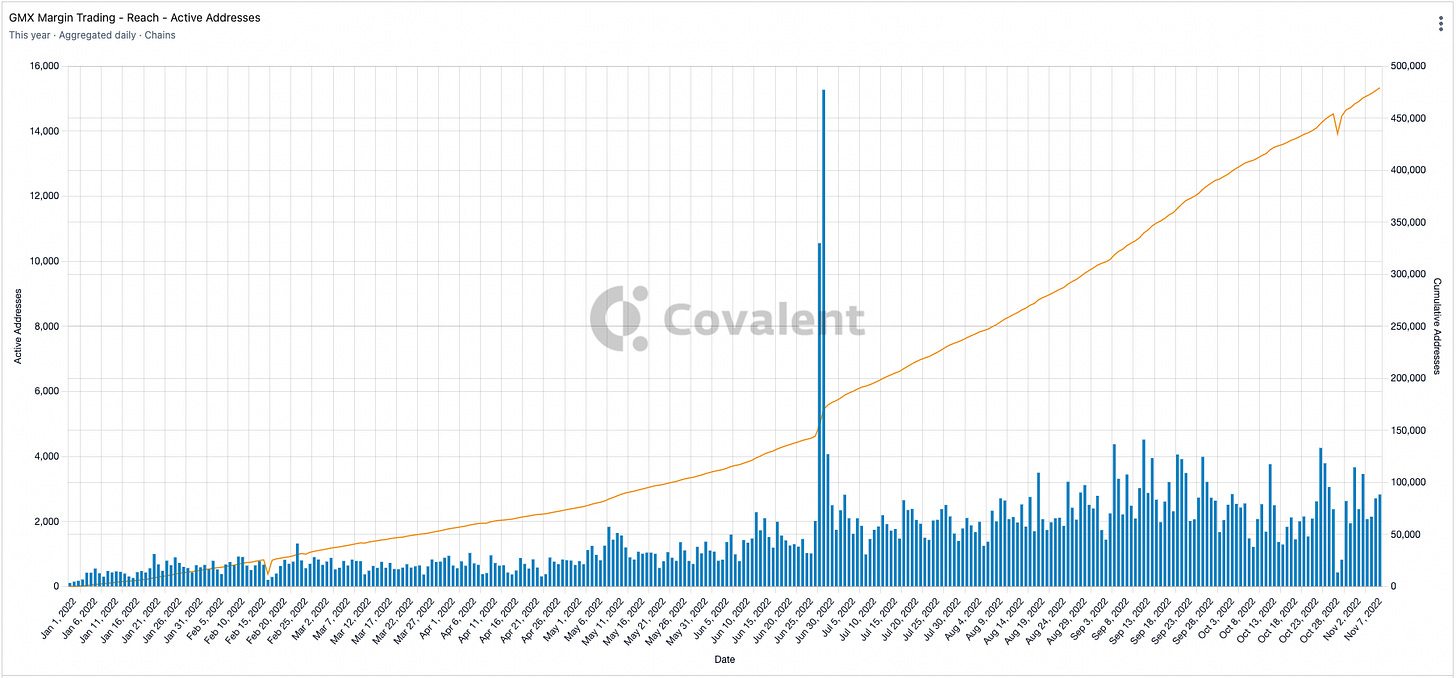

GMX: Active Addresses

Perp v2: Active Addresses

GMX shows steady growth in its reach, with transactions and active addresses per day continually climbing. Both metrics peaked on 29 June 2022 - when Arbitrum Odyssey’s Week 2 kicked off with GMX as the protocol of the week. Additionally, there was some uptick in activity in early May, just after the GMX Referral Program was released. Cumulative transactions on the protocol this year stand at 1,011,297 with 479,243 active total active addresses.

Perp v2 started the year with increasing transactions on the protocol up to a peak on 11 May 2022 (coinciding with the announcement of OP rewards for Optimism projects). Since then transactions had been slowly decreasing until a recent increase in October (just as Optimism Quests were released). Active addresses on Perp v2 behaved similarly until mid-Sep when the daily active addresses saw a huge jump and still seem to be increasing. This coincides with the launch of Optimism Quests, as mentioned above. Cumulative transactions on the protocol this year stand at 6,037,704 with 250,111 total active addresses.

Comparing the two protocols shows that GMX is likely home to swing traders, taking trades over a longer time period. Whereas traders on Perp seem to trade far more frequently, usually with much smaller size.

Retention

Retention surrounds retaining a user base. The health of a project can be monitored through the retention rates of users, which ultimately highlight a team’s ability to create an effective product with a captivating user experience. Tracking retention is extremely important to ensure fast growth rates in new users do not provide a false sense of security of product-market fit — eventually, growth will slow and by that time new entrants must have been converted to frequent users.

GMX: DAU vs WAU vs MAU (Daily, Weekly, Monthly Active Users)

Perp v2: DAU vs WAU vs MAU

GMX: Stickiness Ratio (DAU/MAU)

Perp v2: Stickiness Ratio (DAU/MAU)

GMX: Cohort Retention

Perp v2: Cohort Retention

GMX can be seen to lose stickiness through the bear market (starting in Nov 2021), to be expected as participants leave the market. A low of just under 4% was witnessed in June 2022, however, this was coinciding with Arbitrum Odyssey, where we can expect one-time users to be rife. From this point, stickiness can be seen to be rising again, as users gain trust in the protocol, all whilst Active User metrics continually rise throughout the year.

Perp, on the other hand, can be seen to climb in stickiness throughout 2022 to a peak in August of over 17%. However, active address numbers at this time were fairly low (and not climbing), so a strengthing in the core users during the bear could be expected. Stickiness then begins to fall sharply as more addresses are using the protocol, likely due to Optimism Quests. More time is required to determine if these new users will stick around on the protocol.

In terms of cohort retention, GMX outperforms Perp, with 10% of the January 2022 cohort still using the protocol in November so far compared to Perp’s 2%. This behaviour can be seen across the year where GMX outperforms in almost every month selected.

Revenue

Revenue concerns monetising the user base. Revenue growth is the key to proving product-market fit and should be the primary group of metrics to make informed decisions around allocating resources and setting fee rates. Baseline revenue data can be further probed on when making these decisions, to understand if it originates from a specific user type or particular product offering, for example.

GMX: Volume

Perp v2: Volume

GMX: Net Trader PnL

Perp v2: Net Trader PnL

GMX: TVL

Perp v2: TVL

GMX volume has been extremely consistent for the entire year, with the cumulative volume sitting at $124B. Net Trader PnL is also shown, as this shows what LPs are counterparty to — this year, traders on GMX have lost $14.6M, absorbed by LPs, enticing minting of GLP and a higher TVL. Higher TVL in the pool means deeper liquidity for more traders at larger sizes, allowing for more volume to be processed on the platform. TVL on GMX has consistently climbed for the majority of the year, with some substantial loss over May-June during the LUNA-UST downfall. This has since been replaced and continued to grow, peaking recently at $514M this month (the largest liquidity pool on Arbitrum).

Perp v2 had a strong start to the year in volume, peaking on 11 May 2022, when OP rewards for projects were announced. Soon after this event, the volume drops off significantly, only to return above $50M/day a few times in June. Unfortunately, to make the picture even worse for Perp, this was also around the same time they stopped arbitrage trading on their own exchange - where before May, they were responsible for 20-60% of the volume. The cumulative volume is now sitting at $12.8B. In terms of Net Trader PnL, this year traders on Perp have lost $12.3M, absorbed by LPs. TVL on Perp had a strong start to the year, consistently climbing to a peak in April, before a significant loss during the LUNA-UST downfall, flatlining now around $22M.

Both platforms charge a fee for margin trading, at 0.1% of the position size. Therefore, fees haven’t been shown here as they mirror volume. For more insight into these protocols, check out many other charts on my Increment Pages: